The Pink Diamonds Tender

Storage of Wealth since 1983

500% ↑ 2000 – 2020

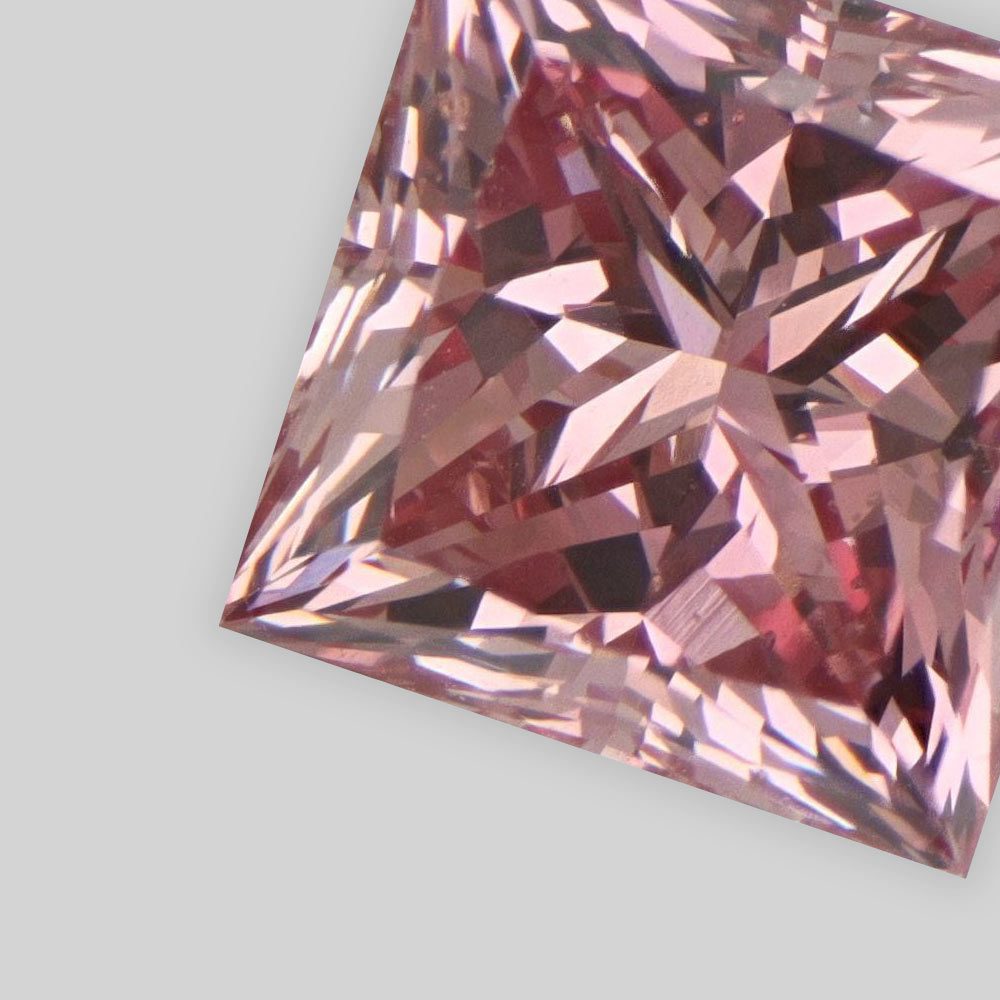

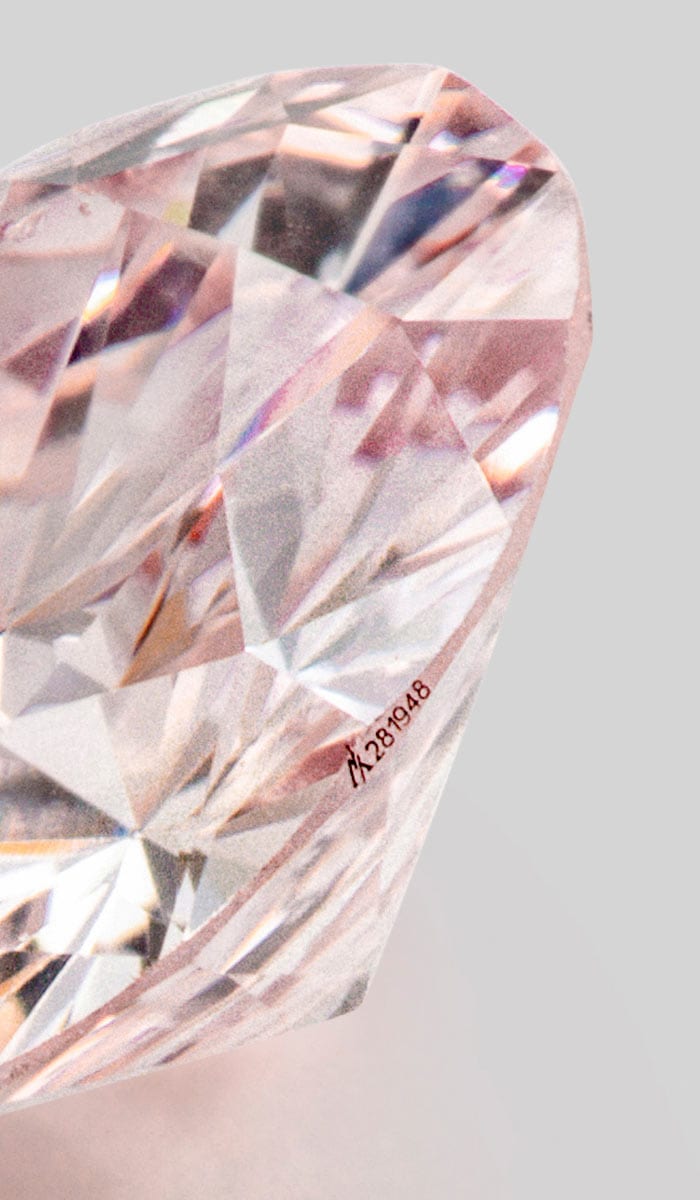

Rare Australian Pink Diamonds

In 1979 a glittering pink diamond was discovered on top of an anthill in a remote part of the Kimberly wilderness in Western Australia. When the subsequent Argyle mine commenced production in 1983, this would be the beginning of an extraordinary story about the search for the very rarest of rare diamonds created over 1.6 billion years ago.

The Argyle Diamond Mine has produced over 90% of the world’s pink diamonds during the last 38 years. However, deposits were limited and the Argyle Diamond Mine ceased operations in November 2020. Whilst the demand and popularity of pink diamonds grows stronger supply from the world’s primary producer has come to an end.

They say that it would take twenty years to fill a crystal wine glass with the very finest pinks discovered at the Argyle Diamond Mine during its comparatively short history.

Yourdiamonds.com™ is honoured to have been appointed to conduct the First Public Sealed Bid Tender of Australian Pink Diamonds. We are proud to have been entrusted with mandates from the esteemed collector, Ms Di Fitzpatrick of Brisbane, a South Australian financial corporation and eight private collectors to offer for sale so many beautiful and rare pink diamonds all of which are appearing on the secondary market for the very first time.

Current Tenders

The latest announcements, news and information around fashion, finance, business and who’s who in the diamond industry.

q&a

Are pink diamonds going to increase in value?

q&a

What are my options to sell my pink diamond?

Past

Tenders

The latest announcements, news and information around fashion, finance, business and who’s who in the diamond industry.

The Argyle Diamond Mine provides the terminology used by the mine to colour grade pink diamonds produced by it.