looking to buy?

It’s simple

Our quick steps will ensure a smooth and enjoyable experience. See how it works below.

q&a

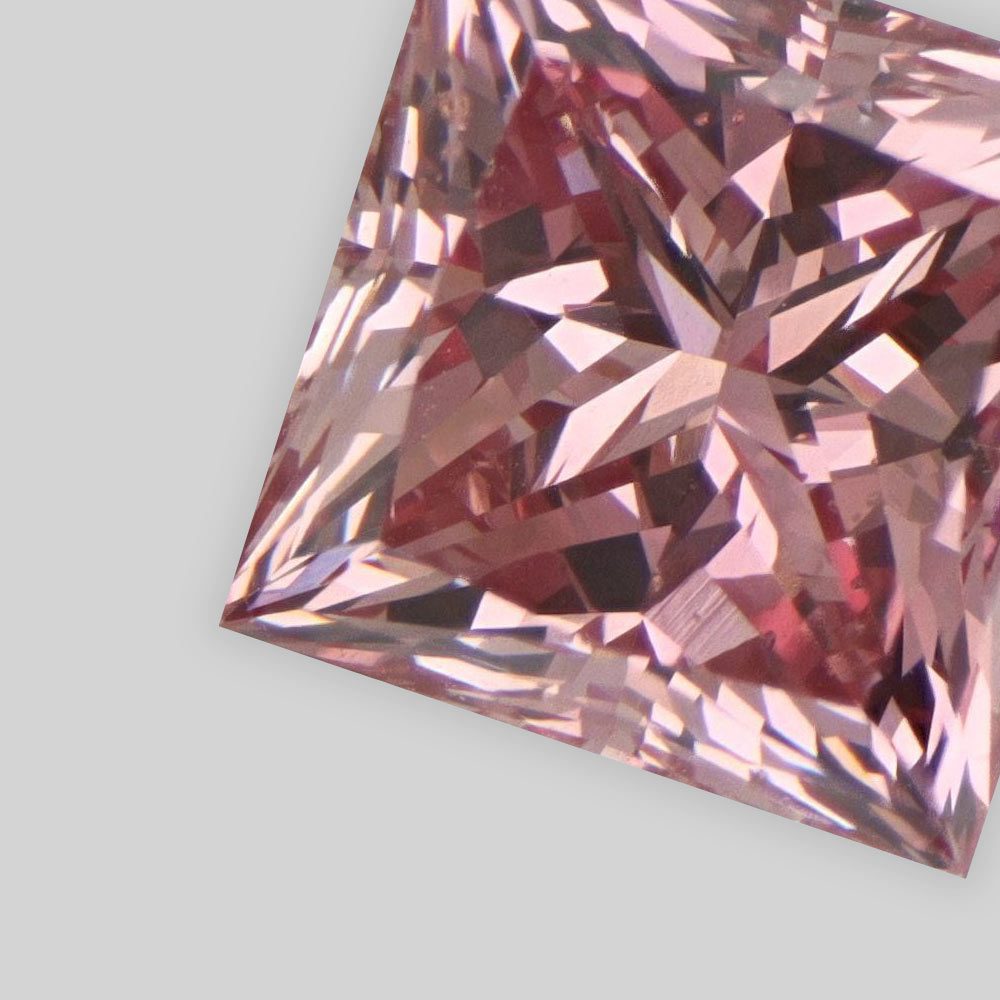

Are pink diamonds going to increase in value?

The Argyle Diamond Mine provides the terminology used by the mine to colour grade pink diamonds produced by it.